If you’re a business owner, then you should know that one of the most important KPIs (Key Performance Indicators) to track is your Customer Lifetime Value, otherwise known as CLV, CLTV, or LTV.

Customer Lifetime Value is a metric that helps you measure the average profitability of each customer with your business.

In other words, how much, on average, someone is worth to your business.

In order to calculate Customer Lifetime Value, you first need to know the formulas to use to help you determine how much a customer is worth to your business. This guide will help you with just that.

Customer Lifetime Value

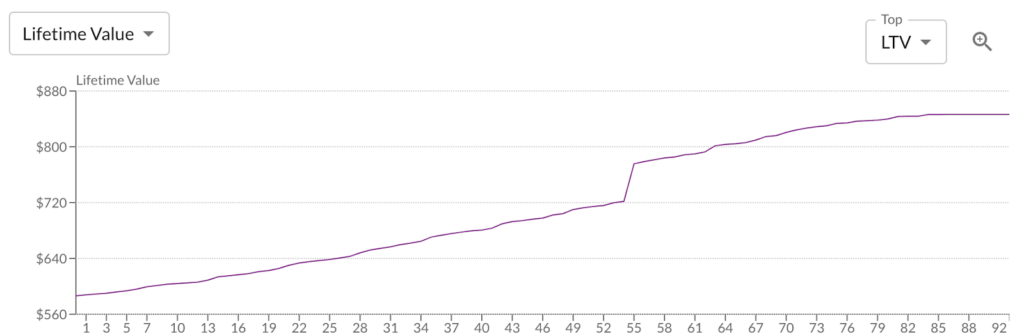

CLV is a metric that measures the total amount of revenue that a customer will generate for your business over the entire course of their relationship with you.

Obviously, the higher the Customer Lifetime Value, the better. In general, businesses with high Customer Lifetime Values are more successful, can survive longer, and have more satisfied customers.

There are a number of reasons why Customer Lifetime Value is such an important metric.

- First, it can help you identify and target your most valuable customers.

- Second, it can help you figure out how profitable your marketing campaigns to get new customers might be.

- And finally, it can give you insight into which aspects of your business are most likely to result in long-term customer satisfaction.

All of this information is incredibly valuable for business owners who are looking to grow and improve their businesses for the short and long term.

So, if you’re not already tracking Customer Lifetime Value, be sure to start doing so as soon as possible.

Calculating Customer Lifetime Value

To figure out the Customer Lifetime Value, you’ll need to find three key pieces of information within the time frame you’ve set:

- Average Order Value

- Frequency of Purchase

- Customer Value

And don’t worry, we’ll walk through what each of these terms mean.

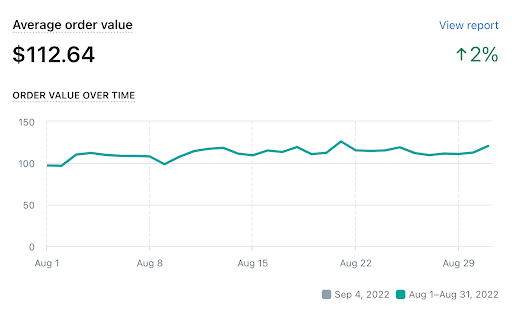

Average Order Value (AOV)

The average order value is how much money a customer spends, on average, in your store over a period of time. In this situation, let’s say one year.

So if Customer #1 spent $50 and Customer #2 spent $100, the average order value for those two orders would be $75.

To get this number, all you have to do is divide your total sales by the total number of orders.

Formula: Total Sales / Order Count = Average Order Value

Frequency of Purchase

The average number of orders placed by customers is represented by purchase frequency.

In this scenario, if five customers bought one item each, and 10 customers bought three items each within a year then the purchase frequency would be 2.3.

To get this number you must divide your total number of orders (35) by your total number of distinct clients (15).

*Remember, when calculating your purchase frequency use numbers from the same time period as your average order value calculations.

Your customers’ frequency of purchase will be the end result.

Formula: Total Orders / Total Customers = Purchase Frequency

Customer Value

Customer value is the average monetary worth that each client contributes to your company over the period of time you’ve chosen.

So, if we took our average order value ($75) and multiplied it by our purchase frequency (2.3) then we would get a customer value of $172.5.

To get your customer value, simply multiply your average order value by the frequency of your purchases.

Formula: Average Order Value x Purchase Frequency = Customer Value

After you have all three, your Customer Lifetime Value may be easily determined by multiplying your customer value by the average customer lifespan.

What is the average customer lifespan? The period of time until a customer becomes inactive and stops making purchases permanently.

So, if your customer is worth $172.5 but their life span on average is 1.5 years, then their Customer Lifetime Value is $258.75.

On the other hand, if they had an average customer lifespan of half a year (0.5) then the Customer Lifetime Value would be $86.25.

Formula: Customer Value x Average Customer Lifespan = Customer Lifetime Value

Increasing Customer Lifetime Value

Although your calculations may have produced some positive outcomes, there is always room for improvement.

More than 90% of businesses have a program to encourage customers to stay with them. They are one of the best ways to bring in more money and keep customers coming back.

Additionally, more than 84% of people say they would stick with a brand that has a loyalty program, while 66% of those people say that getting rewards does affect how much they spend.

Consider using a loyalty program to show your most loyal customers that you appreciate them.

You can encourage upsells and cross-sells by offering things like:

- Reward Points

- Free Gift Cards

- Discounts

- Bonus Items

Conclusion

In short, Customer Lifetime Value is important because it can help you understand how much revenue a customer is likely to generate for your business over the course of their relationship with you.

It also includes finding three key pieces of information: average order value, frequency of purchase, and customer value.

Finally, using rewards and loyalty programs is one way to increase CLV – so if you’re not doing so already, consider adding them to your marketing strategy!